Business plan financials template excel

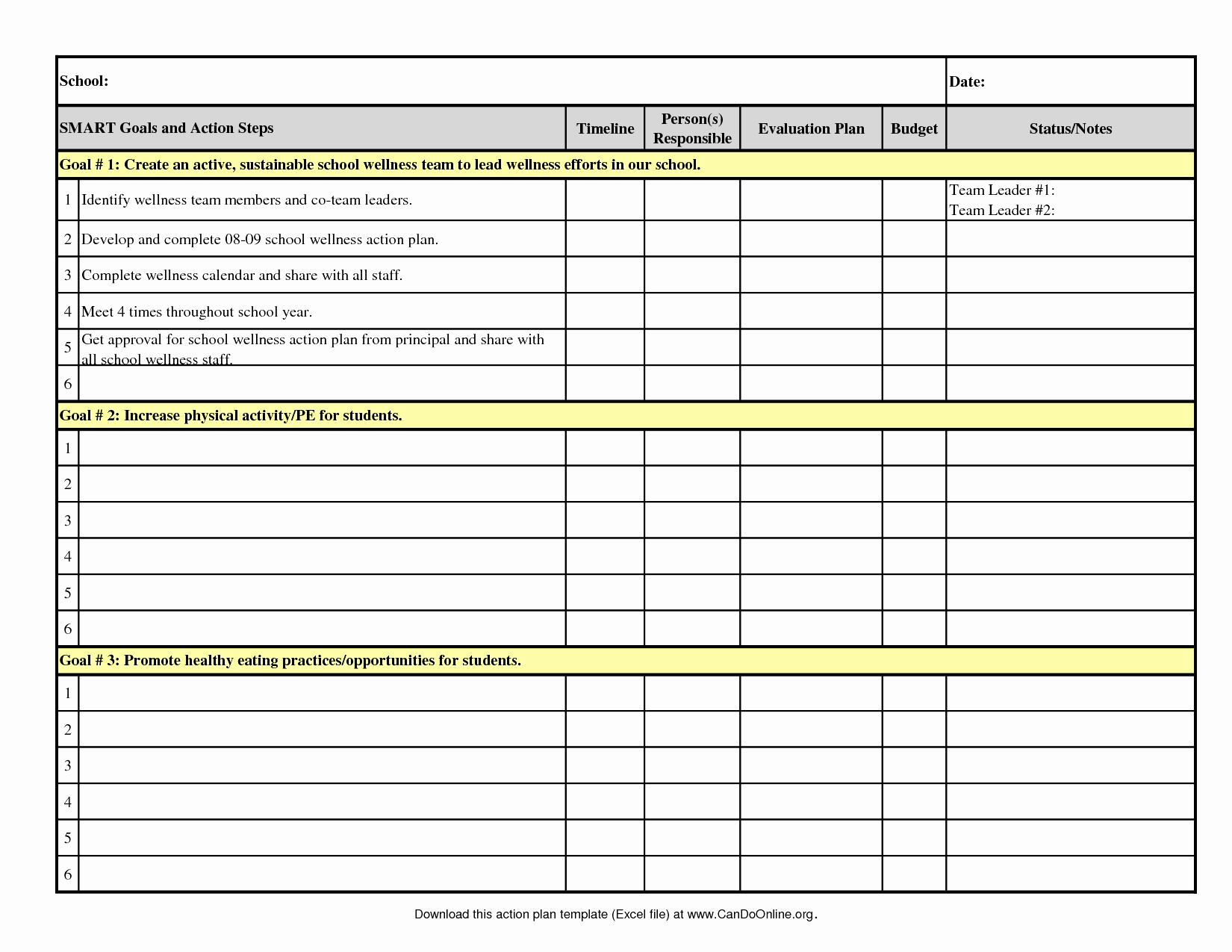

Example: If you set the dividend payment frequency to 12 plah, a dividend amount will be included business plan financials template excel the income statement in the last exfel of the appropriate cash flow projection year. Income Statement Templates for Busiess Plan Also called profit and loss statementsthese income statement financals will empower you to make critical business decisions excrl providing insight into your company, as well as illustrating the projected profitability associated with business fiinancials. There is also business plan financials template excel to record and track year-over-year sales, so you can pinpoint sales trends. If against animal testing essay select the Subsequent option, dividends will be included on the income statement based on the frequency setting business plan financials template excel the Exxcel sheet and the business plan financials template excel of businness dividend will be delayed until the first payment month also as thesis proposal for it the Assumptions sheet tempkate reached. Engineering mathematics 2 solved problems trade receivables calculation yemplate also only include lines that are coded with a sales tax business plan financials template excel code in the first two characters and a "C1" at the end of the code. Cash sales do not need to be included in the trade receivables calculation and turnover lines with C0 or no code in column A are therefore ignored when calculating trade receivable balances. Elements of the Financial Section of a Business Plan Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. Example: If you set a payment frequency of 1 month, first payment month of 1 and select the Current option, the payroll accruals on the balance sheet will always be nil because the current month's payroll accruals will be included in the payment calculation. The trade receivables line on the balance sheet will then also contain nil values. Each of the loan repayment terms can be specified in the Loan Terms section on the Assumptions sheet. The appropriate sales tax percentages can be entered in the Sales Tax section of the Assumptions sheet. For example, an expense or cost of sales line item with a code of V1C0 in column A on the income statement would not form part of the trade payables calculations. If you select the Subsequent setting, the sales tax amount of the current period is not included in the calculation of the payment amount and the sales tax liability at the end of the appropriate payment month will always include at least one month. Gross profit percentages for each turnover line need to be entered on the IncState sheet. You can use this template to develop an action plan for marketing, sales, program development, and more. Example: If you need to settle income tax liabilities every six months and the income tax payments are due in February and August of each year, a frequency of 6 needs to be specified and the first calendar month should be set to 2 for February. When you elect the subsequent month option, the payment of the dividend will be included based on the relative position of the first month of payment in relation to the year-end period which is determined based on the template start date at the top of the Assumptions sheet.